Large-Scale Battery Storage as a Key Technology of the Energy Transition – And How Sustainable Storage Projects Become Attractive Investments

Renewable energy is only half the battle. The other half? Storage.

A wind farm somewhere in Northern Europe. The turbines spin tirelessly in the strong Pentecost wind. A brilliant blue sky stretches above, 25°C, holiday calm. While much of Europe soaks up the sun, wind and solar installations generate more electricity than is consumed — it’s one of the lowest-consumption days of the year.

Table of contents

The wind continues to blow, but the wind farm is disconnected from the grid. The turbines stand still, despite the strong breeze. The grid is overloaded, no buyer, no suitable power storage. Electricity that was produced CO₂-free is wasted. What sounds like an exception is everyday reality in a transforming energy system. Battery storage is the answer to this gap, technically advanced, politically supported, economically attractive.

Pure solar projects often no longer pay off because the compensation for fed-in electricity keeps decreasing. That’s why many project developers are now focusing on solar parks with battery storage – both at the same location. This allows them to store the electricity and sell it when prices are higher. It increases revenue and makes the investment more attractive

Investing in Battery Storage Means Thinking in Decades — Not Quarters

The battery storage market is booming. The projected market volume for battery storage in Europe is growing rapidly: In 2024 alone, 11.9 GW of storage capacity was installed, bringing the total capacity to 89 GW. The reason: no storage, no stable grid — and no real energy transition. Those who invest in storage projects today are backing a vision for a low-emission energy landscape, strong return potential, and societal relevance. An investment that makes both economic and ecological sense.

Battery Storage: Key Enablers of Tomorrow’s Energy System

Battery storage systems will play a dual role in the energy system of the future: acting as short-term buffers and strategic grid stabilizers. Across Europe, large-scale battery storage is crucial for building flexible, stable power grids. In 2024, for the first time, more front-of-the-meter (FTM) capacity was installed than behind-the-meter (BTM) in Europe, a trend that is expected to continue.

(Source: https://www.infolink-group.com/energy-article/energy-storage-topic-global-energy-storage-market-review-outlook?utm_source=chatgpt.com)

A large-scale battery is essentially a giant power bank. It takes in electricity from renewable sources, stores it temporarily, and releases it back into the grid in a controlled manner. Especially during grid congestion and increased PV and wind input, these systems are indispensable.

According to Energiezukunft.eu grid operators and industrial firms are showing a growing interest in large-scale storage systems. They offer planning security, resilience, and attractive economic prospects.

Another driver: battery storage systems can be installed precisely where grid bottlenecks occur. They are a flexible tool for stabilizing the grid—an aspect highlighted in “Der Spiegel” under the term „Batterie-Tsunami“ . The upcoming wave of storage projects has the potential to fundamentally reshape the energy system.

Local Storage Projects: Opportunities for Communities and Landowners

As the expansion of renewable energy progresses, so too does the need for high-performance, scalable battery systems. These are of interest not only to utilities and grid operators, but also to industrial firms, project developers, municipalities, and private landowners. Those who provide suitable land can benefit economically through lease models or profit-sharing, while actively supporting the local energy transition.

This is where sustainable investment projects come in—financing the construction and operation of such storage systems.

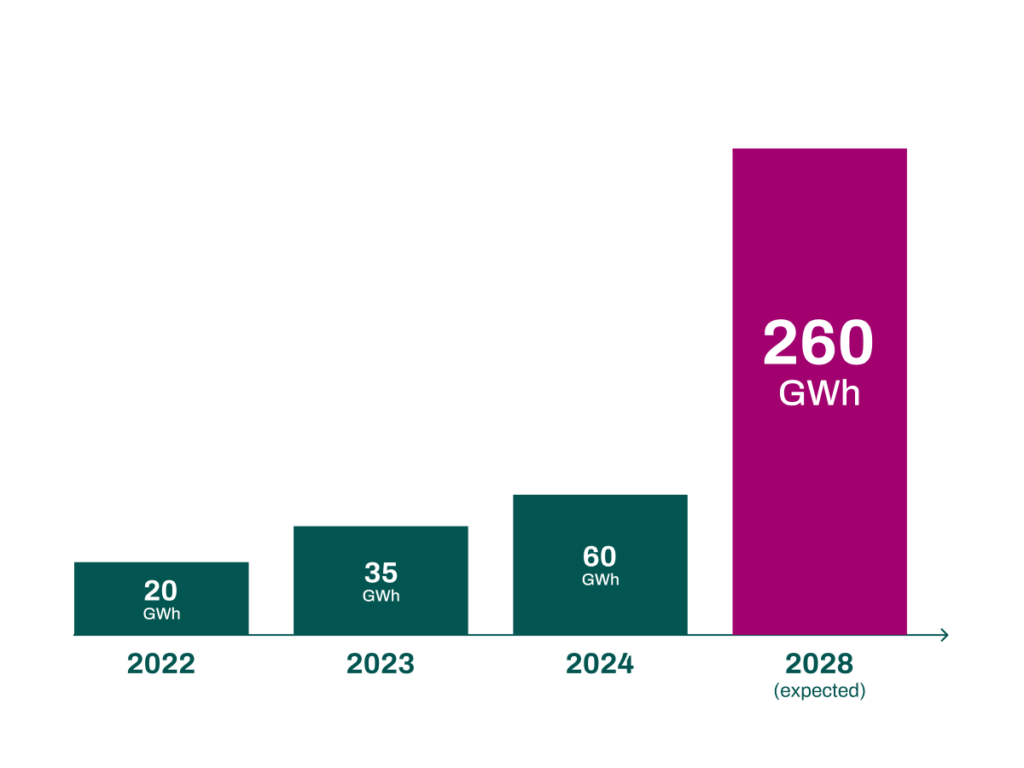

Installed and expected total capacity of large-scale battery storage systems in Europe. Initial value at the end of 2023: 35.9 GWh; forecasts according to the European Market Outlook for Battery Storage 2024-2028 (SolarPower Europe, medium scenario) show an increase to around 260 GWh by the end of 2028. Data status: April 2025.

(Source: SolarPower Europe, European Market Outlook for Battery Storage 2024-2028 & Pressemitteilung vom 11.06.2024 (Medium-Szenario).

Infobox: What Do European Studies Say About Battery Storage?

European studies like the European Market Monitor on Energy Storage (EMMES 9.0) by EASE and LCP Delta and the ACER Monitoring Report on Electricity Infrastructure analyze the political and structural framework for meaningful battery storage expansion in Europe. (Source: Energy-Storage.News)

According to EMMES 9.0, 11.9 GW of new storage capacity was installed in Europe in 2024, bringing the total to 89 GW. The report forecasts continued strong growth through 2030, driven by technological progress, policy support, and other key factors.

(Source: EASE Storage)

Key Takeaways:

- ✅ Battery storage is essential for flexible use of renewable electricity and grid relief — especially during weather-driven fluctuations.

- ✅ Grid-supportive operation is key: storage helps only when it charges or discharges during grid bottlenecks — not all storage activity is automatically helpful.

- ✅ Today’s market is not enough: purely market-driven expansion does not align with specific regional grid needs.

- ✅ New EU regulation brings momentum: Regulation 2024/1747 obliges member states to set binding flexibility targets—including storage strategies—alongside renewable energy targets.

- ✅ European market analyses recommend clear targets for storage: to reduce grid bottlenecks long-term, legally binding expansion targets should be set for power storage, similar to renewables.

(Studies: European Market Monitor on Energy Storage (EMMES 9.0), EASE & LCP Delta, März 2025, ACER Monitoringbericht zur Strominfrastruktur, Dezember 2024)

How Sustainable Are Battery Storage Systems Really?

The seemingly simple logic behind battery storage deserves a closer look. True sustainability is not achieved merely by storing energy. The ecological impact of battery storage depends heavily on how the systems are produced, operated, and recycled.

- Raw Materials: Most modern systems use lithium-ion technology. The extraction of lithium, cobalt, and nickel raises concerns, but European manufacturers increasingly rely on certified supply chains, European raw material partnerships, circular economy practices, and second-life usage—supported by initiatives like the European Raw Materials Alliance (ERMA).

- Lifespan: Battery storage systems are more durable than commonly assumed. Depending on the system, they last 10 to 20 years and are often reused as second-life systems afterward.

- Recycling: Research into sustainable recycling methods is advancing across Europe. Specialized plants in countries like France, Belgium, and Germany can recover up to 90% of materials—using hydrometallurgical processes and automated disassembly.

A recent study by BayWa r.e. confirms that large-scale battery storage will be key in accelerating the energy transition in Europe. These systems reduce CO₂ emissions and costs, while increasingly stabilizing the grid during volatile power generation—crucial for integrating more renewables reliably into the grid. (Source: BayWa r.e. Studie zu Batteriespeichern)

Investing in Large-Scale Battery Storage: What Do Energy Market Trends Mean for Investors?

Studies and market trends show that battery storage is evolving from a technical component into a strategic asset class. Politically supported, regulatory backed, and increasingly profitable.

According to Energiezukunft and European market analyses, storage solutions are increasingly being integrated into scalable business models – for example, in combination with digital control systems and Power Purchase Agreements (PPAs), which are long-term electricity supply contracts between generators and buyers. ( Source: energiezukunft.eu)

This trend is also supported at the European level: The European Commission plans to relax state aid rules to stimulate investment in clean technologies, including energy storage. (https://www.reuters.com/sustainability/eu-set-loosen-state-aid-rules-spur-green-projects-draft-shows-2025-02-18) Additionally, targeted measures are proposed to strengthen and de-risk Power Purchase Agreements across the EU. (https://www.reuters.com/markets/europe/eu-commission-propose-help-de-risk-power-deals-document-shows-2025-02-18)

Concrete support examples, such as the €1.2 billion Polish aid program for energy storage investments, demonstrate the EU’s active commitment to expanding energy storage solutions. (https://ec.europa.eu/commission/presscorner/detail/it/ip_24_4985)

For investors, this means: investing in battery storage today offers access to a clearly defined growth market with high impact. This is not about risky startups, but about stable, well-structured business models. Investments are made in real infrastructure — facilities that are built or under construction. Often, there are long-term power purchase agreements, and sometimes energy is sold flexibly via smart algorithms that respond to market signals to maximize returns.

The study shows that battery storage is gaining importance in both energy policy and the economy. Targeted expansion is technically sensible and economically relevant— enhancing long-term investment conditions and improving predictability and security.

Investing in battery storage means supporting the energy transition and participating in a rapidly growing and regulation-backed future market.

Project Financing Explained: How Battery Storage Investment Works

The battery storage projects offered via Invesdor are structured as project financing models. This means you’re not investing in an entire company, but in a dedicated legal entity created specifically to build and operate the storage project.

Your capital goes directly into constructing the facility—clear, purpose-driven, and transparent.

- Attractive Market Environment: Market storage systems have the potential—depending on the business model—to generate solid returns.

- Diversified Business Models Possible: Storage operators may have secured revenue contracts or agreements with optimization firms that sell storage capacity and electricity across different markets for optimized return.

- Collateral Not Always Needed: Unlike traditional corporate financing, BESS project financing is based on a specific asset, such as a battery storage unit. Future revenues can be more accurately projected than those of a full company. Repayment is made exclusively from the project’s income, with a sufficient buffer to reduce risks from market fluctuations.

- Term & Yield: Project durations can be short, medium, or long term (1–10 years), offering fixed interest returns with a balanced risk-reward profile.

This model suits investors looking to diversify their portfolio with fixed-income, sustainable investments that have a direct impact on a specific project.

Sustainable Investment for the Energy Transition

Investing in battery storage means actively supporting the energy transition. But the technology is evolving fast. How reliable are individual projects? Which storage solutions will prevail? And how can investors tell whether a project is truly viable?

Not all storage projects are equal: differences lie in the technology used, provider structure, contract terms, and risk mitigation. That’s why Invesdor emphasizes careful selection. Only projects with proven technology, reliable partners, and clear revenue models are offered for financing.

Transparency, security, and sustainability are core criteria in the selection process.

Battery Storage as a stable, sensible Investment

The expansion of renewable energy requires powerful storage. And these storage systems need capital. Investing in a battery storage project combines ecological impact with sound economics.

Learn more about our current projects and invest in the companies shaping tomorrow’s energy landscape—concretely and sustainably.

Check out our investment projects HERE .