What investors should know about storage, grids and systems

Table of contents

When energy supply suddenly becomes fragile

And suddenly the power is out. Countless households must be evacuated. People spend the night in poorly heated gyms—including those who require special care. This happened in January 2026 in Germany’s capital, Berlin.

For a long time, energy in Europe was considered a given. But events of recent years—from geopolitical tensions and extreme weather to local blackouts like in Berlin—have shown how vulnerable even highly developed energy systems can be.

These experiences make one thing clear: energy security is not just a national issue. It is a European task—technically, economically, and politically. And there are solutions if we think beyond borders.

Europe’s energy transition: from a technology issue to an infrastructure challenge

Europe is pursuing ambitious goals in the expansion of renewable energy. Solar and wind power are being massively scaled up in nearly all member states. Solar energy has become a central pillar of electricity generation in many European countries. From Southern Europe to Scandinavia, installed capacity is growing—on residential rooftops, in industrial facilities, and in large-scale solar parks. Wind power complements this generation, especially in coastal areas and offshore. (Quelle: Solarpower )

Solar and wind energy are becoming more important

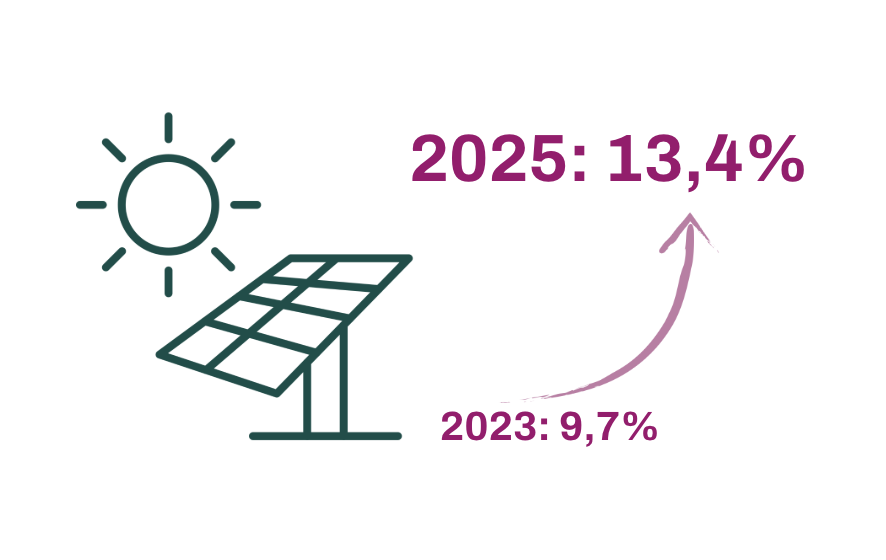

- Solar will cover around 13.4% of EU

electricity demand in 2025 (2023: 9.7%).

- In June 2025, solar became the EU’s largest

electricity source for the first time.

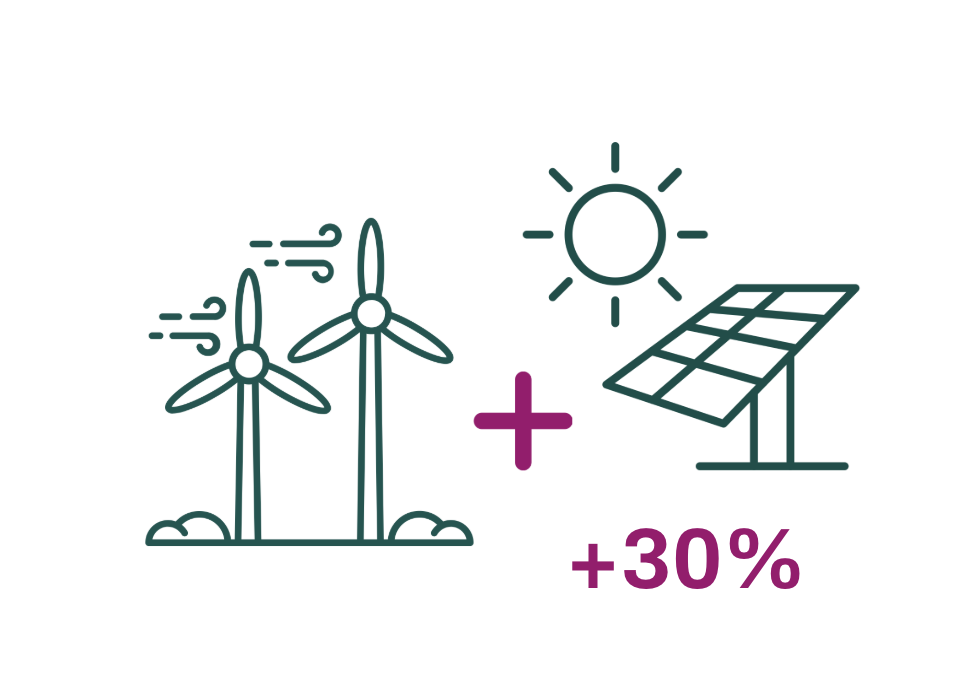

- Wind and solar together now supply over

30% of electricity, increasingly displacing

fossil fuels.

(Sources: Solarpowereurope, Wikipedia )

For Europa this means:

- high scalability

- regional value creation

- reduced dependency on energy imports

Manufacturers of solar panels and wind components are an essential part of the system. They drive technological innovation, expand production capacity, and ensure stable supply chains—all prerequisites for the continued expansion of renewables in Europe.

But with this growth, the energy system itself is changing. Traditional power plants delivered electricity on demand; renewables are weather-dependent. Consumption follows different patterns: industry, households, mobility and digitalization create demand peaks at specific times of day.

This leads to imbalances. And this is where it becomes clear that the energy transition is not just about technology—it’s about infrastructure. It’s about the interaction between generation, storage, grids and intelligent control—real, investable structures.

Energy generation in Europe: solar and wind as the foundation

Solar and wind power form the foundation of renewable energy generation in Europe. Both technologies are mature, scalable and competitive in the long term. At the same time, Europe is developing new production capacities for solar panels, inverters and wind components to stabilize supply chains and reduce dependencies.

For investors, projects in this area are attractive when they are well integrated into regional energy structures. Key factors include site quality, grid connection, operational concepts and long-term marketing models. Pure generation without storage or flexible marketing is increasingly hitting economic limits.

Case study: scalable solar energy (financed via Invesdor)

A good example of system-oriented solar energy is Der Solarteur. The company plans and installs photovoltaic systems, as well as heating and battery systems, for the housing sector and for commercial and industrial customers.

Since its founding in 2021, Der Solateur has completed over 2,800 installations. It addresses a key bottleneck of the energy transition: the need for scalable, qualityassured solutions to quickly decarbonize existing buildings, especially for large housing providers.

Digitalized processes, reliable supply chains and experienced installation teams allow the execution of large-scale projects—a clear advantage in a fragmented market. A framework agreement with one of Europe’s largest housing companies highlights the company’s strategic positioning.

Remarkable:

The project sparked strong interest among investors: €1.1 million was funded in less than 48 hours.

The market shows: generation remains the foundation—but it’s only the first step.

This is where sustainable investment projects come in, financing the construction and operation of such storage facilities.

Battery storage: the key to Europe’s energy security

Renewable energy is generated when the sun shines, the wind blows, or water flows. It depends on the weather and, unlike fossil fuels, cannot be easily controlled by humans. So how can we still use these forms of energy reliably and make them predictable? Battery storage fills a crucial gap in Europe’s energy system. It absorbs electricity when supply is abundant and releases it when demand and prices rise. This makes renewables more predictable and economically viable.

Technically, battery storage systems perform several tasks:

- ✅ stabilizing power grids

- ✅ balancing load peaks

- ✅ reducing curtailment of generation plants .

Europe’s battery storage market is growing rapidly. According to the European Market Outlook for Battery Storage 2025–2029 installed capacity is set to grow significantly in the coming years—driven by rising demand for flexibility.

Large-scale storage, neighborhood solutions, and hybrid solar-storage projects are developing into infrastructure investments. They help make national grids more resilient to unexpected events.

For households, businesses and entire neighborhoods, storage solutions can increase independence from central grids.

Case study: battery storage for system stabilization (financed via Invesdor)

Two examples of grid-supporting Battery Energy Storage Systems (BESS) on Invesdor

are BESS Remscheid Luckhausen and BESS Wehr. Both use battery systems to store surplus electricity from renewable sources and feed it back into the grid later.

These systems balance load peaks, reduce curtailment of solar and wind power, and contribute to grid stability. They exemplify how battery storage becomes a core part of energy infrastructure—both technically and economically. Such projects also open up new revenue potential through flexible electricity trading and increase the predictability of renewable energy.

For investors this means: storage is no longer a supplement—it’s a key value driver.

Energy infrastructure: the often underestimated investment factor

Between generation and consumption lies infrastructure. Grids, substations, connections, installations and maintenance ensure that renewable electricity actually reaches where it’s needed.

This area is highly relevant for sustainable investment. Infrastructure projects stand out through long-term use, predictable income, and high system relevance. They form the backbone of the energy transition and are being promoted and expanded at the European level.

Infrastructure may be less visible than solar panels or wind turbines – but it’s often decisive for the system’s overall stability and profitability.

Case study: wind power as integrated energy infrastructure (financed via Invesdor)

Wind power creates the most value when it is operated continuously, at scale and integrated into the grid. Projects like Windpark Fryslân and Westermeerwind on Invesdor do just that.

Both parks feed significant amounts of renewable electricity into the grid and contribute reliably to Europe’s energy supply. What matters is not only the generation capacity but the integration into existing grid infrastructure. As long-term infrastructure projects, these wind farms combine renewable electricity production with energy security and regional value creation.

Digital control: efficiency that drives returns

As energy systems become more decentralized, digital control grows in importance. Smart grids and energy management systems coordinate generation, storage and consumption in real time. They determine when electricity is stored, used, or traded.

Digital solutions are a key factor in the profitability of modern energy projects. They increase income predictability, reduce losses, and allow flexible responses to market prices. Technology and software are closely tied to stable returns.

Investing in renewable energy in Europe: projects with substance

This systemic perspective opens up new opportunities for investors. Potential lies not just in individual technologies but throughout the entire value chain:

- Generation

- Storage

- Infrastructure

- control

Europe is committed to long-term regulation, clear climate goals, and continuous energy infrastructure expansion. This creates planning security—a crucial factor for sustainable investment.

Renewables in Europe are no longer just a climate issue. They’re part of a structural transformation of the energy supply. Those who invest are not betting on isolated products but on a system built on collaboration, scalability and long-term stability.

Renewable energy in Europe: sustainable investment with impact

Transforming Europe’s energy system requires significant investment. Generation, storage, grids and digital control must grow in parallel to maintain system stability.

“Renewable energy investments in Europe are no longer just about climate impact — they are about resilience, security and economic sovereignty. Solar, wind, storage and infrastructure only create real value when they are understood as one interconnected system. Investing in this system means strengthening Europe’s energy independence, stabilising supply in times of crisis, and building long-term, infrastructure-backed returns for investors. That combination of impact and resilience is what makes renewable energy such a compelling investment today.” (Christopher Grätz, CEO Invesdor Group)

Those who participate in these projects invest in infrastructure with societal relevance. This is not about short-term trends but about assets with long-term value and impact.

Sustainable energy projects combine economic rationale with the creation of a future-proof energy system for Europe.

Interested in learning more about investment opportunities in the European energy sector? Find in-depth information and current projects in the field of renewable energy here: