Fixed-income investments offer a stable return on European SME

INVESDOR INSIGHTS | 11.03.2022

Cookies help to improve your website experience and provide secure services. Some cookies are essential for security and login functionalities, others enable easier use and convenient support. You can revoke your decision at any time.

INVESDOR INSIGHTS | 11.03.2022

Last week, we introduced our teams working in Helsinki, Vienna, and Berlin. At the same time, we promised that the merger of our investment platforms will bring even wider investment opportunities to investors. Now is the time to deliver on the promise: get familiar with fixed-income investments! Debt instruments are very popular in Europe, and now available also to our Nordic investors.

Through Invesdor's platform, you can invest in business loans on a crowdfunding basis, with a fixed monthly interest rate. In crowdfunding, a loan applicant is a company that seeks financing for investment or growth from a large number of investors.

Our investment committee checks the eligibility of each individual company before our local contract teams finally add them to Invesdor’s platform. We always provide the investor with a comprehensive description of the company and the purpose of the loan.

Debt-based crowdfunding, also known as crowdlending, has grown rapidly in recent years and is a popular form of fixed-income investment worldwide today. In Germany and Austria, the general form of GmbH differs in many ways from Finnish Ltd companies, and therefore loan rounds are more common there than share issues. Kapilendo and Finnest were the pioneers in enabling crowdlending in Germany and Austria.

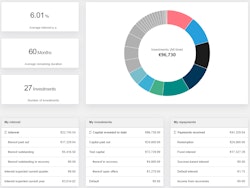

The interest rate or expected return reflects the risk and return of the investment. The higher the risk, the higher the interest rate or expected return. In fixed-income investments offered by Invesdor, the average annual interest rate is 6.5%. We recommend that you share risk by diversifying your investments into several different risk categories and balancing your investment portfolio with higher liquidity investments.

Through Invesdor, it is possible to invest in loans to Finnish, German, and Austrian companies without geographical borders. Business loans bring a good addition to the investment portfolio as they do not significantly correlate with shares or other fixed-income market.

A single fixed-income investment on Invesdor's platform usually has a minimum of only EUR 250, so it is possible to start investing with a small initial capital.

Unlike equity investments, fixed-income investing provides a regular, predetermined return on invested capital. As a result, the fixed-income investor has a better view of how their own investment portfolio is developing.

Unlike equity investments, fixed-income investing provides a regular, predetermined return on invested capital. As a result, the fixed-income investor has a better view of how their own investment portfolio is developing.

Loan rounds have generated millions for European companies to grow and expand.

More than 400 companies have funded their growth on Invesdor’s platform over the past 9 years. Among them are pioneers in mechanical engineering, innovative pharmaceutical companies, and pan-European gastronomic concepts

More than 400 companies have funded their growth on Invesdor’s platform over the past 9 years. Among them are pioneers in mechanical engineering, innovative pharmaceutical companies, and pan-European gastronomic concepts.

Evobeam GmbH is a manufacturer of special welding machines and 3D metal printers. Thanks to Evobeam, high-precision metal parts are used in Mars flights, satellites, jet engines and Formula 1 racing cars. Evobeam financed its additional growth through Invesdor by raising EUR 1 million in financing.

Evobeam GmbH is a manufacturer of special welding machines and 3D metal printers. Thanks to Evobeam, high-precision metal parts are used in Mars flights, satellites, jet engines and Formula 1 racing cars. Evobeam financed its additional growth through Invesdor by raising EUR 1 million in financing.

Biogena develops and manufactures high-quality trace element products and has established itself in Europe. The product range extends from natural products to wellness products. The company has made two loan rounds with Invesdor in 2018 and 2020, raising a total of EUR 5.6 million. Biogena was listed on the Vienna Stock Exchange in 2021.

Biogena develops and manufactures high-quality trace element products and has established itself in Europe. The product range extends from natural products to wellness products. The company has made two loan rounds with Invesdor in 2018 and 2020, raising a total of EUR 5.6 million. Biogena was listed on the Vienna Stock Exchange in 2021.

In the future, we will offer attractive fixed-income investment opportunities also to Nordic investors who have even better opportunities to diversify their portfolios.

Read also:

This is the new Invesdor

Fixed interest or equity investments - which type of return are you aiming for?

Author

DISCLAIMER

The information contained herein is not meant to be, and it shall not be interpreted as investment advice or a recommendation and investors must neither accept any offer for, nor acquire, any securities unless they do so on the basis of the information contained in the applicable investment material of a target company. Investing in securities of unlisted companies is associated with high risk.